Industrial enterprises financial data released by National Bureau of Statistics shows that in January-April 2017, above-scale industrial enterprises gross profit rose 24.4% year on year growth rate of 3.9 percentage points slower than in January-March; which, April profit growth of 14%.

"Industrial profit growth slowed down, is a reasonable return after the previous high growth ." National Bureau of Statistics Industry Secretary Dr. He Ping said, on the overall view, the current industrial profits remain good growth.

Accumulated profits to maintain a high growth rate. From January to April, industrial enterprises above designated size realized a total profit of RMB 2,288.03 billion, an increase of 24.4% and a new profit of RMB 447.3 billion, all of which were the highest in 2012.

"Consumer goods and high-tech manufacturing industry to enhance the role of profit growth in the enhanced." He Ping pointed out that in April, all large industrial enterprises above the new profits, consumer goods manufacturing accounted for 21.6%, compared with March increased by 9.8 percentage points; High-tech manufacturing accounted for 23.2%, an increase of 19 percentage points. While raw material manufacturing accounted for 22.9%, down 15.2 percentage points from March.

Industrial profits not only maintain a good momentum, the enterprise efficiency indicators are also continuous improvement. First, profit margins rose year on year. In April, the profit margin of main business income of industrial enterprises was 5.79%, an increase of 0.1 percentage points year on year. Second, the situation back to continue to improve. At the end of April, the average payback period of accounts receivable of industrial enterprises above designated size was 38.4 days, down by 1 day, which continued the trend of decreasing year-on-year. Third, the leverage rate continued to decline. At the end of April, the asset-liability ratio of industrial enterprises above designated size was 56.2%, down 0.6 percentage points year on year. Fourth, product turnover continues to accelerate. 4 at the end of the scale of industrial enterprises finished product turnover days for 14.4 days, down 0.7 days.

For January to April this year, industrial profit growth slowed down from January to March, the expert analysis, and price factors contributed to the decline in profit growth and other direct correlation.

Data show that industrial producer prices rose 6.4% in April, or 1.2 percentage points lower than in March; industrial producer purchase prices rose 9%, or more than in March fell 1 percentage point. He Ping said this, this is the product prices and purchase price of raw materials to normal return. Preliminary estimates, the price changes to industrial enterprises above the scale of profits increased by about 52.1 billion yuan, less than the March increase of about 59.5 billion yuan.

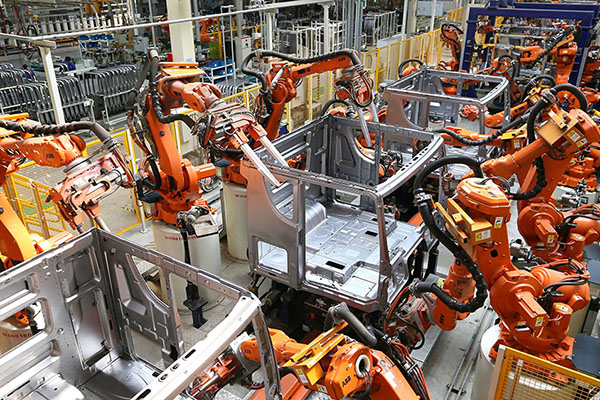

Sub-sectors, steel, automotive and chemical industries such as profit growth slowed down significantly. April, mainly due to price increases fell, production and sales growth slowed down, rising costs and other factors, ferrous metal smelting and rolling processing industry fell 7.8% year on year, while in March increased by 1.3 times; automobile manufacturing profits fell 6.7 %, While in March it grew 18.7%; chemical raw materials and chemical manufacturing industry profits rose 13%, an increase of 20.8 percentage points lower than in March; oil and natural gas mining industry profit of 5.45 billion yuan, less than in March by 9.86 billion Yuan; electricity and heat production and supply industry profits fell 42% year on year, a decline of 14.4 percentage points higher than in March. The above five industries together affect the full scale of industrial enterprises above the profit growth slowed 10.8 percentage points.

"To maintain steady growth in industrial profits, the current need to pay close attention to two issues." He Ping reminded that the purchase price of raw materials faster than the ex-factory price, resulting in the entire industry, especially in the downstream industry costs. In April, the cost of industrial enterprises over the scale of the main business income of 86.22 yuan, up 0.18 yuan. Second, the increase in financial costs, corporate financing costs there is upward pressure. In April, corporate finance costs increased by 4.2%, an increase of 1.2 percentage points faster than in March.